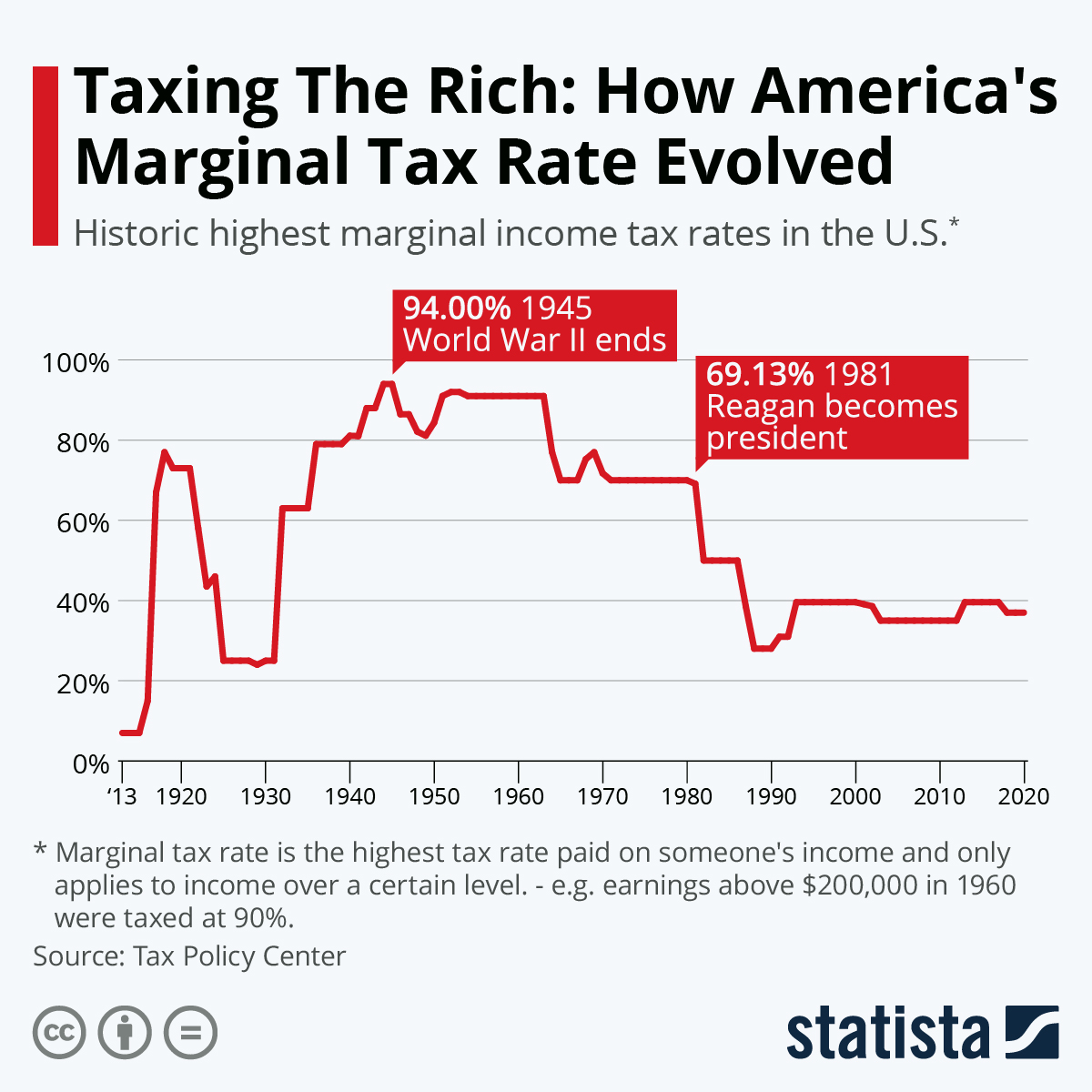

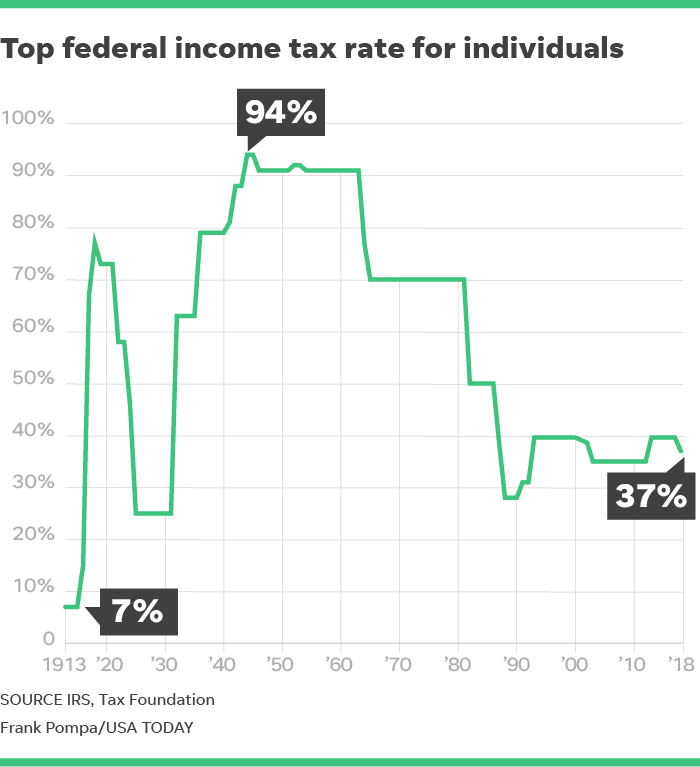

The top tax rate has been cut six times since 1980 — usually with Democrats' help - The Washington Post

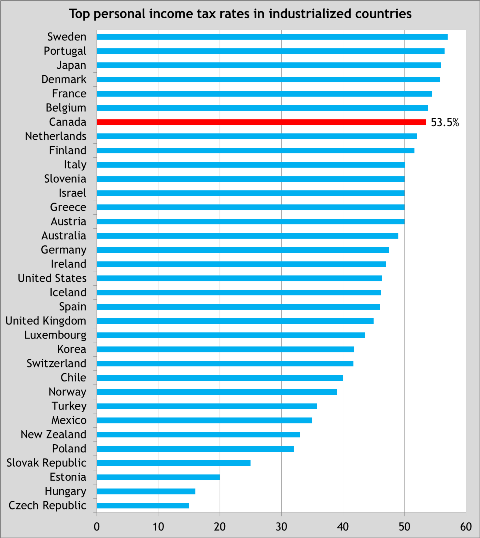

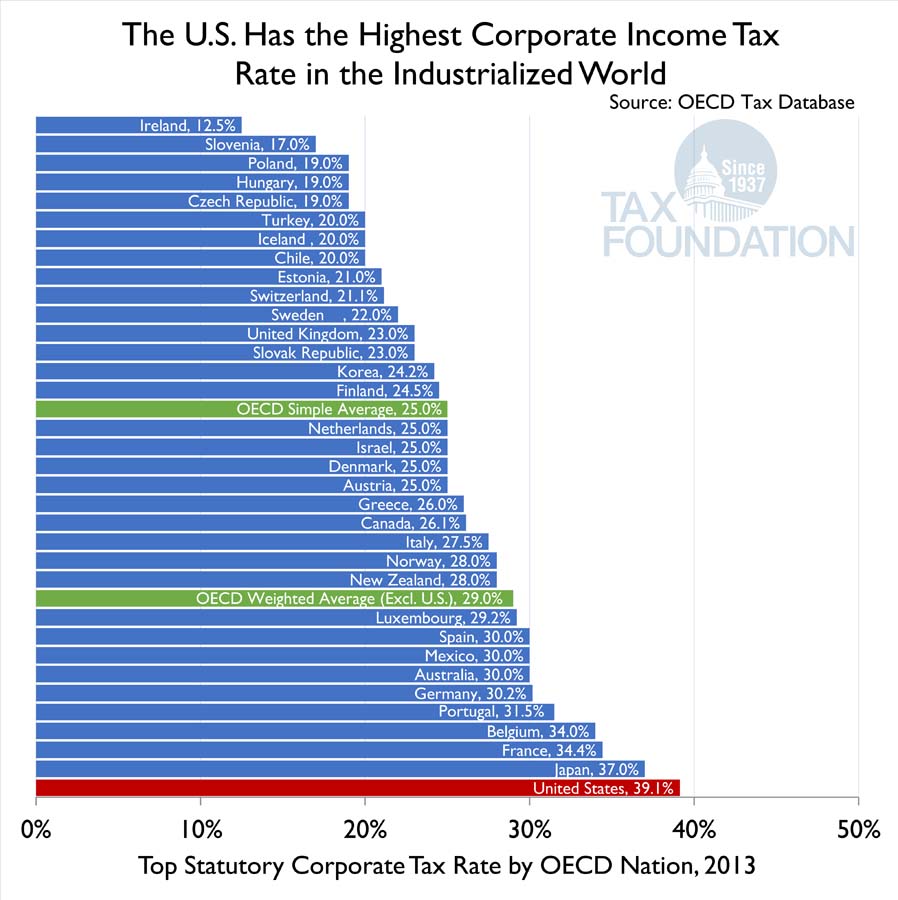

US Would Have Highest Top Income Tax Rate Among Developed Nations Under Biden Plan, New Analysis Warns - Foundation for Economic Education

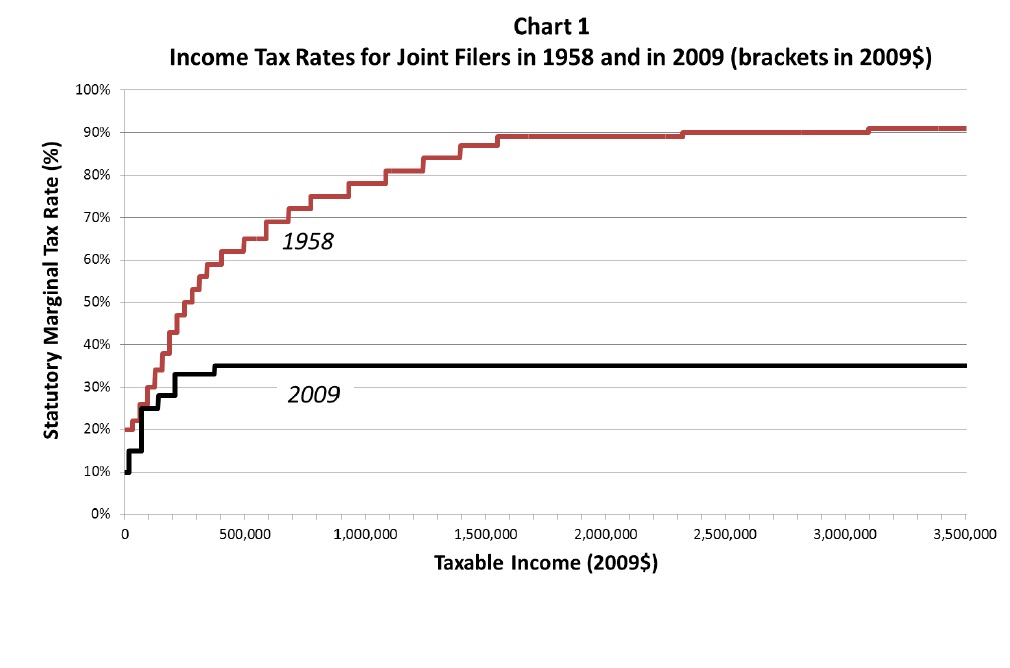

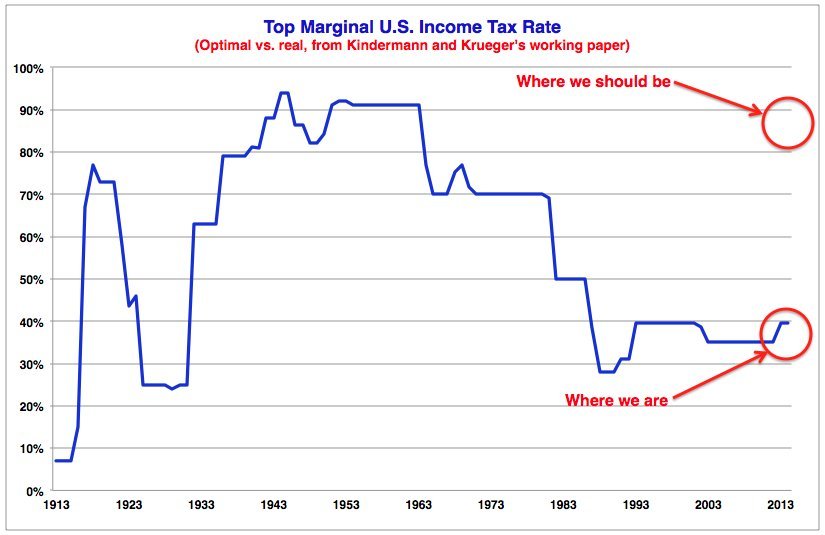

If the top U.S. tax rate were to increased to 91% what would the effective rate be for typical top earners? - Quora

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)